When a national financial advisory firm needed an innovative system to support their financial services regulatory compliance, they discovered the Gadens Breach Manager solution, which is deployed through Lawcadia.

The Client

Fitzpatricks Private Wealth, a national advisory and wealth management firm.

The Challenge

New complex and systemic financial services regulatory reforms were introduced on 1 October 2021, including mandatory breach reporting. In preparation for the heightened focus on regulatory compliance, Fitzpatricks Private Wealth recognised that their existing software and spreadsheets would not be sufficient and that they would need additional tools, systems, and resources to provide the appropriate framework and structure to support the breadth of requirements.

“It’s not just the breach reporting … it’s integrating that process into our monitoring and supervision process, making sure that we’ve got a feedback process to capture complaints when they need to be escalated. Also, when an incident triggers the need to undertake a broader investigation, how do we actually capture that and make sure that we’re doing the right things at the right time – and getting it all right?” Lyn Dixon, Head of Advice Compliance at Fitzpatricks Private Wealth.

In addition to the practical tools and systems, Fitzpatricks identified that educating their advisors and making it easy for them to comply with the new reforms would be critical to success.

“These are complex and systemic regulatory reforms that the industry is going through, and it is the job of compliance and regulatory teams, along with technology providers and legal advisors, to make compliance as intuitive and as efficient as possible.” Liam Hennessy, Partner at Gadens.

The Approach

Fitzpatricks’ compliance team prepared a criterion of key requirements. Specifically, the team were seeking to implement a system that would:

- Be able to navigate and identify relevant penalty provisions from thousands across the regulatory landscape

- Be maintained and updated by external experts

- Allow for data to be exported and / or integrated with other management systems

- Incorporate workflows to capture and track an incident and breach management treatment

- Manage mandatory reporting timeframes and compliance processes across numerous matters simultaneously

- Incorporate other functions such as complaints management, audit, and risk management, to provide a single view across the business

According to Fitzpatricks Head of Advice Compliance, Lyn Dixon, they could find no provider who was able to meet those key criteria – until they came across the Gadens Breach Manager, which is deployed using the Lawcadia platform.

The Solution

Fitzpatricks implemented the Gadens Breach Manager, a tool designed for risk, compliance, and legal professionals, with a complex legal content and workflow automations that assist with the identification and analysis to determine if an incident is a reportable regulatory breach. The Gadens Breach Manager is powered by the Lawcadia platform – an intelligent automation and matter management system – and can automatically brief Gadens’ regulatory team for external advice when required.

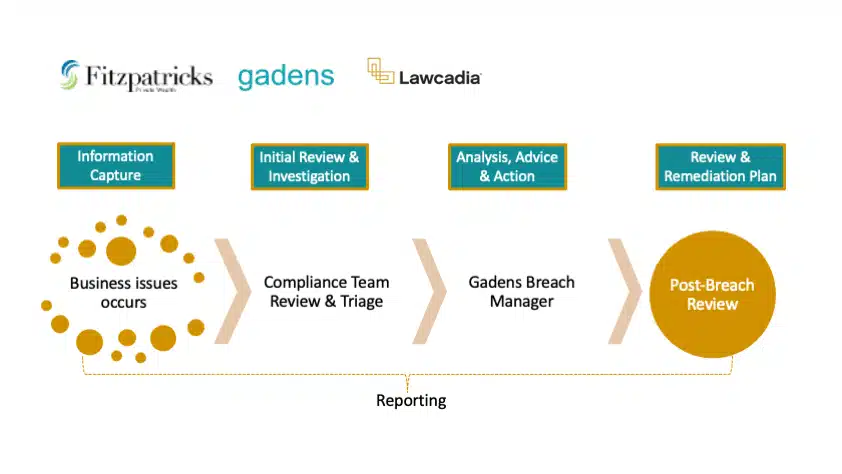

Fitzpatricks chose to complement the Gadens Breach Manager with additional Lawcadia workflows to provide a staged process for the compliance team to readily capture issues and incidents from their advisors, review and investigate potential breaches, utilise the Gadens Breach Manager for analysis and expert advice, and finally to provide a robust documentation of the post-incident review, remediation, and treatment along with root cause (see Figure 1).

Finally, the ability to access data and reporting across all aspects of the process was utilised to provide appropriate management reports.

Figure 1

The Benefits

According to Lyn Dixon, Head of Advice Compliance at Fitzpatricks, they now have confidence that they have access to the relevant legal and regulatory information when they need it, that they have dealt with and recorded each matter properly, as well as an increased granularity in their investigations.

Importantly, they have also been successful in removing barriers for their advisors by making it easy for them to communicate issues and potential incidents. Advisors can easily access a simple form through their internal advisor portal that captures the key information that the compliance team need to review and investigate.

“We want to make it as easy as we can for our advisors to comply and a key part of that is making it easy for them to communicate when something is not right, and they are unsure they should report it.” Lyn Dixon, Head of Advice Compliance, Fitzpatricks Private Wealth.

Customer Success

“With the Gadens Breach Manager and Lawcadia we are confident that we have the right structures and frameworks in place for a robust compliance function.” Lyn Dixon, Head of Advice Compliance, Fitzpatricks Private Wealth.

View this webinar to discover more about Fitzpatricks’ innovative approach to managing the volume and direct the flow of work arising from the breach reporting and other regulatory reforms.